According to Bloomberg, CLSA Ltd. strategist Russell Napier thinks so:

"While the 39 percent drop in the S&P this year pushed equity prices below replacement cost, history suggests the ratio must sink further as deflation sets in, he said. The S&P may plunge another 55 percent to a trough of 400 by 2014, the strategist said.

"Things have always looked absolutely terrible at the bottom," said Napier, Institutional Investor’s top-ranked Asia strategist from 1997-1999. With deflation "the value of assets falls and the value of debt stays up, then equity gets crushed. The results are always horrific.""

|

0 Comments

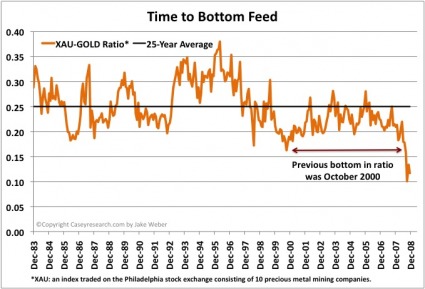

A recent issue of Agora's 5 Minute Forecast contained two useful and interesting concepts. The first looked at the relationships between oil and gold: Casey Research recently posted the above image with comments paraphrased below. Not often you hear talk like this from a bank like Citigroup: |

AboutThe End Times Portfolio helps prepare you and your family to safely survive social unrest and navigate turmoil in financial markets through sound investing that hedges against catastrophic market risk. Archives

August 2011

|